[ad_1]

I quickly discovered last year how ChatGPT can improve search engine optimization. Google now claims Gemini, its own AI tool, is more powerful.

So I tested Google’s claim, using Gemini for the same SEO tasks. I used the latest iterations of both platforms: ChatGPT4 and Gemini Advanced.

Here are my findings.

On-page Optimization

My initial prompt:

My target keyword is “audio textbooks.” This is my article [URL]. Is it well-optimized for that keyword?

ChatGPT listed what it considered:

I’ll check:

- The presence and usage of “audio textbooks” in critical areas (title, headers, etc.).

- Overall content structure and readability.

- Relevant linking practices.

- Technical aspects like mobile responsiveness and loading speed.

It then produced generic recommendations, indicating it didn’t analyze the page. Here’s what it offered for internal links (I’ve bolded the text):

Ensure some internal links to other relevant content on your site are included if not already.

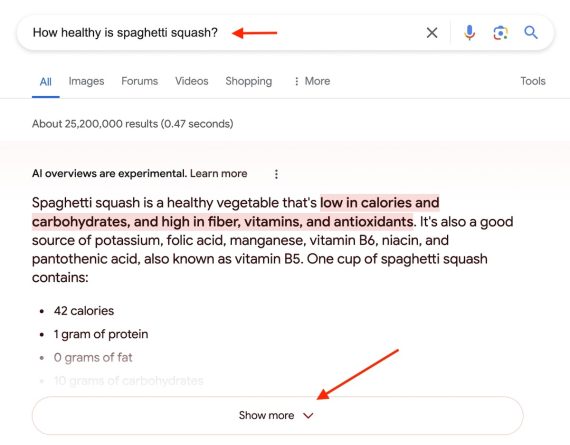

Gemini was even less helpful, stating,

I wasn’t able to determine from the article itself whether it is optimized for the keyword. However, I can search on the web and see if there are any SEO best practices that you can follow to improve your article.

I then pasted the entire article into the Gemini prompt. It made no difference. Gemini failed to analyze the content and instead provided routine SEO tips.

Content Helpfulness Analysis

My next prompt:

Is my article helpful for someone searching for audio textbooks? How can I make it more helpful?

Both responses were worthwhile. ChatGPT provided ideas missing from my article, especially “Accessibility Features.”

- Expand Content: Include detailed reviews of various platforms offering audio textbooks, comparing features like user experience, availability of titles, and subscription costs, if any.

- User Guides: Provide step-by-step guides on how to access or download these audiobooks from mentioned sites.

- Accessibility Features: Discuss accessibility options available for visually impaired or dyslexic users.

Gemini offered its own good idea:

The article could be more helpful by including a table that compares the different options, such as cost, selection of textbooks, and ease of use.

Interestingly, this time Gemini accessed my page. Although I’m now wondering if Gemini is blocked from performing direct SEO.

Gemini appeared to access the page when analyzing the content.

Keyword Research

My next prompt:

Which additional keywords should I optimize this article for? List related keywords, synonyms, close concepts, etc. Explain why each keyword is a good idea for that context. Make it a table.

Both platforms provided useful keywords and listed “free audiobooks” as the top suggestion. I’ve replicated both tables for this article.

| Keyword (ChatGPT) | Explanation (ChatGPT) |

|---|---|

| Free Audiobooks | Broadens the appeal to users looking for free audio content, not limited to textbooks. |

| Educational Audiobooks | Targets users specifically looking for audiobooks with educational content. |

| Audio Learning Resources | Captures searches related to audio formats used for educational purposes. |

| Audiobook Apps for Students | Reaches a demographic specifically using mobile apps for educational audiobooks. |

| Downloadable Textbooks | Appeals to users looking for textbooks in various formats, including audio. |

| E-textbooks | Taps into the market for electronic versions of textbooks, closely related to audio versions. |

| Textbook Alternatives | Attracts searches from users looking for different forms of learning materials beyond traditional books. |

| Study Aids | Connects with users looking for supportive educational tools, including audio summaries. |

| Audiobook Reviews | Caters to users deciding between different audiobook services based on reviews. |

| Accessible Learning Tools | Focuses on inclusivity, appealing to users who need accessible learning formats, such as audio. |

| Keyword (Gemini) | Reason for Inclusion (Gemini) |

|---|---|

| free audiobooks | Many users searching for audio textbooks might be cost-conscious and looking for free options. |

| educational audiobooks | This is a broader term that captures users looking for audiobooks for learning purposes, not just textbooks. |

| learning audiobooks | Similar to “educational audiobooks” but emphasizes the learning aspect. |

| audiobook textbooks | This rephrases your target keyword “audio textbooks” but might be used in searches. |

| TTS audiobooks | This targets users who might be unfamiliar with the term “text-to-speech” but interested in this method. |

| read aloud textbooks | This is a more natural way some users might describe what they’re looking for. |

| ebooks for dyslexic students | This is a close concept that targets a specific audience (dyslexic students) who might benefit from audio textbooks. |

| audiobooks for visually impaired | Similar to “ebooks for dyslexic students” but targets users with visual impairments. |

| alternative formats for textbooks | This is a broader term that captures users looking for any alternative format to traditional textbooks, including audio. |

Source link